Family offices plan to increase acquisitions and investments in the coming 12 months, and a minority expect to hike their activity “dramatically,” according to research from , a global provider of services to clients including family offices and high net worth individuals.

Ocorian interviewed 301 family office professionals in Europe, Asia, the Middle East, North America and the UK.

The study found that 94 per cent of respondents said they expect to increase the number of acquisitions and investments their family office makes this year compared with 2023. Around 18 per cent expect to hike such acquisitions dramatically and 6 per cent see no change.

“The family office sector is growing rapidly and going through a series of tactical and more structural changes – as the study shows – with family offices set to go on a buying spree in the year ahead,” Amy Collins, head of Family Office at Ocorian, said.

Such a survey comes at a time when the asset allocation conversation has changed after almost two years of rising interest rates, which have knocked parts of the private markets space – such as venture capital – increased the "risk-free" rate and reintroduced the appeal of the traditional "60/40" equities/bonds split.

Around 62 per cent of respondents said they will expand acquisition plans because they regard company valuations as being more realistic; 60 per cent said the rising cost of debt forces companies to find more investors to provide capital.

Part of the rise in acquisitions is down to a strategic shift – nearly half (49 per cent) questioned said they want to increase levels of direct investing while 21 per cent per cent said they are cash rich and 9 per cent said they must diversify.

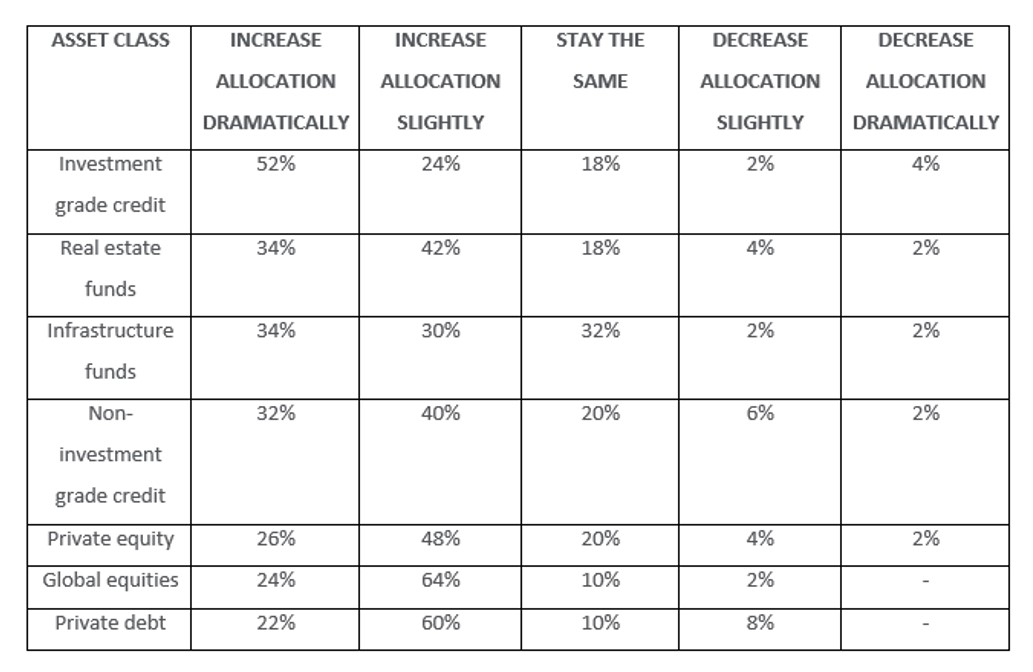

The study found that investment grade credit is likely to see the biggest rise in family office investment allocations this year with more than half (52 per cent) planning to increase allocations dramatically. However all alternative asset classes and global equities are likely to see more investments from family offices as the table below shows.

Source: Ocorian

In November 2023, Ocorian commissioned research firm PureProfile to survey the family office executives. The study interviewed family offices in the US, the UK, Canada, China, Germany, India, Norway, Saudi Arabia, Singapore, South Africa, Sweden Switzerland, the UAE, Denmark, France and Japan.